Since a certificate of transfer of real estate and affidavit for transfer of real estate are not forms of conveyance but simply recorded evidence of transfer of title to real estate which have already taken place as a matter of law, the following instruments shall not be governed by these standards, however, they shall be submitted to the map office for review prior to transfer and recording:Ī) Certificate of transfer of real estate.ī) Affidavit for transfer of real estate.Ĭ) A conveyance of an interest in the real estate described in such certificate or affidavit, as set forth in (a) and (b) above, by an owner named in either of said instruments to another such owner.ĥ.

If such metes and bounds description cannot be prepared from the existing plats or surveys, a new survey will be needed.Ĥ. Vacated street and alleys must be described by a metes and bounds legal description at the time of conveyance, not at the time of vacation.

A new survey and legal description will be needed whenever a parcel has a legal description that in the opinion of the County Engineer does not clearly define the area to be conveyed.ģ. The survey plat and description so filed are public records under Section 149.43 of the Revised Code.Ģ. If, after the County Engineer’s review, the County Engineer determines that the survey plat and description satisfy those standards, the County Engineer shall approve the survey plat and description, and shall file a copy of the survey plat and description in the engineer’s survey file. The error of closure shall not exceed one in ten thousand.

#Conveyance of property form registration

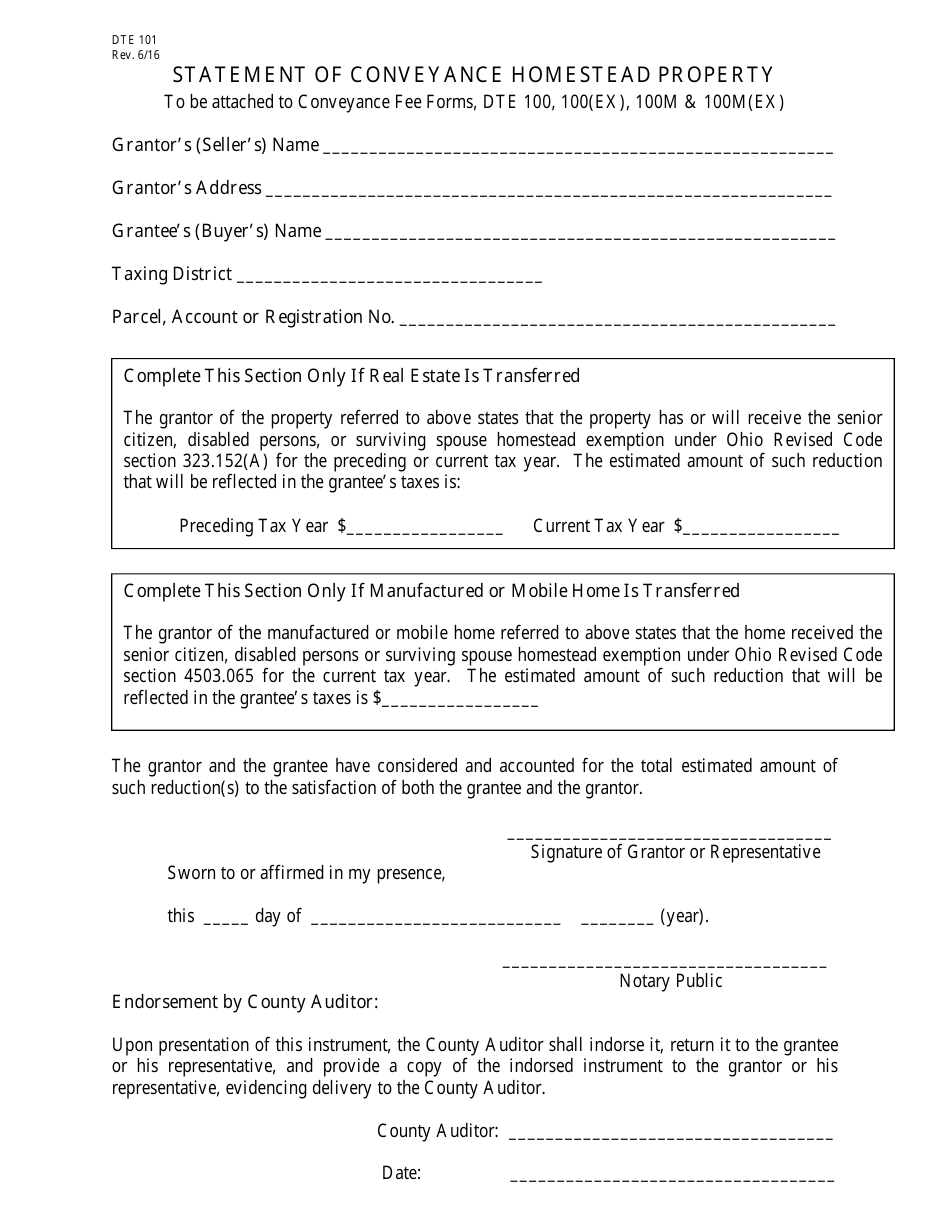

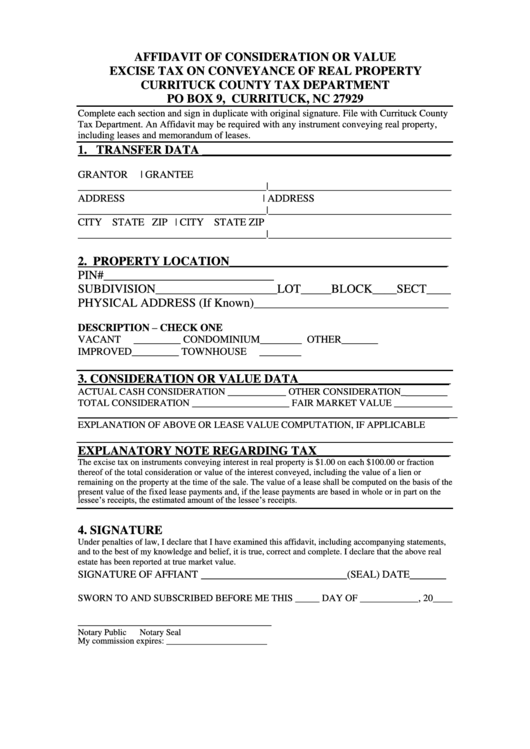

Even if there have been more than four (4) conveyances out of a parcel since May 9, 1996, the Engineer may, for good cause, waive the requirement of a new boundary survey.ī) If a boundary survey is required by this section, the survey plat and description shall satisfy the minimum standards for boundary surveys promulgated by the Board of Registration for Professional Engineers and Surveyors pursuant to chapter 4733 of the Ohio Revised Code, and shall be submitted to the County Engineer for review. Good cause includes, but is not limited to, the irregular shapes of tracts conveyed out, the total number of properties conveyed out including those prior to May 9, 1996, or any other person which undermines the basic purposes of these standards. Notwithstanding paragraph (ii), the Engineer, for good cause, may require a boundary survey even if there have been fewer than four (4) conveyances out since May 6, 1996. A boundary survey shall not be required when a Grantor conveys all of his remaining land notwithstanding the fact that he has previously conveyed off one (1) or more tracts, provided that there have not been more than four (4) tracts conveyed out since (regardless of ownership). A boundary survey shall not be required for a new split of over ten (10) acres if it can be described by fractional section description. New Boundary Survey & Legal Description NeededĪ) A boundary survey shall be made whenever land to be conveyed is only a part of the Grantor’s land or the legal description of the land to be conveyed is different from the legal description of the land conveyed in the most recent conveyance of all or part of that land, however: View the New Document Standards for the Recorder's Office Jpage. Transfer fee is $0.50 per parcel or deed. (DTE Form 102) is required if the grantor (seller) of property being conveyed was qualified for the current agricultural use valuation (CAUV) for the preceding or current tax year.Conveyance Fee is $4 per $1,000 of the purchase price. Statement of Conveyance of Current Agricultural Use Value Property (DTE Form 101) is required if the grantor (seller) of the property being conveyed was entitled to the Homestead reduction for the preceding or current tax year. Statement of Conveyance of Homestead Property Transfer fee is $.50 (fifty cents) per parcel.Ĭonveyance Form for Real Property and InstructionsĮxemption from Real Property Conveyance Form (DTE 100EX)

#Conveyance of property form code

The purpose of transferring deeds through the Auditor is to maintain an accurate record of property ownership and parcel identification and to collect conveyance fees required by Ohio Revised Code (ORC) Section 319.20 and 322.02.Ĭlermont County conveyance fees are $4.00 (four dollars) per $1000.00 (one thousand dollars) of consideration rounded up to the nearest one hundred dollars.

0 kommentar(er)

0 kommentar(er)